So, I was beginning to think about the implications of this mortgage market ‘crisis’, and the US economy as a whole, and how it all might impact my investment decisions. One thing I’ve noticed over the last few years is how forgetful the media and frankly, investment pundits are. They all get so myopic and transfixed on the immediacy of the ‘crisis’ we’re in at the time. Sometimes I wish they’d pull back and give a nice big macro-view of the markets. That’s not gonna happen, so I thought I’d do a little of my own lay analysis of the real estate market.

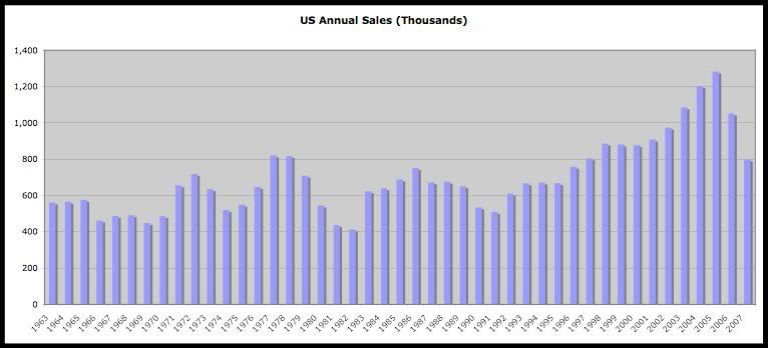

We are back to 1996-97 sales volume levels (US wide). That’s an amazing drop-off in unit sales since the start of 06.

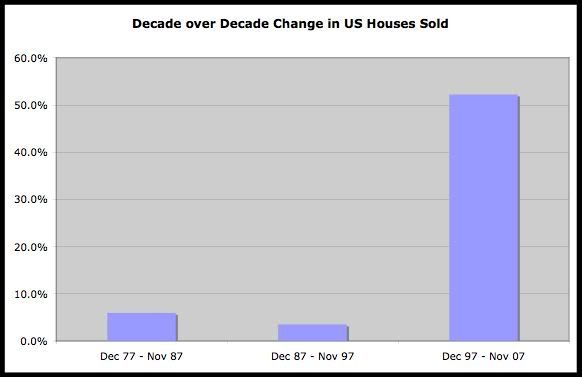

But what’s more amazing is the massive sales volume increase in the last decade vs. the relatively steady volume over the prior 3 decades. A 50% rise in unit sales decade over decade, whereas the decade prior saw only a 3.5% increase, and a 6% increase the decade previous to that.

…yet, looking at median home values across the US, it’s amazing how strong the growth remains over the long haul, almost regardless of sales volume

…despite that, looking at the rate of growth (note the predictable 10 year down-cycles), there’s a significant slowing in the growth rate over the last 30 years…

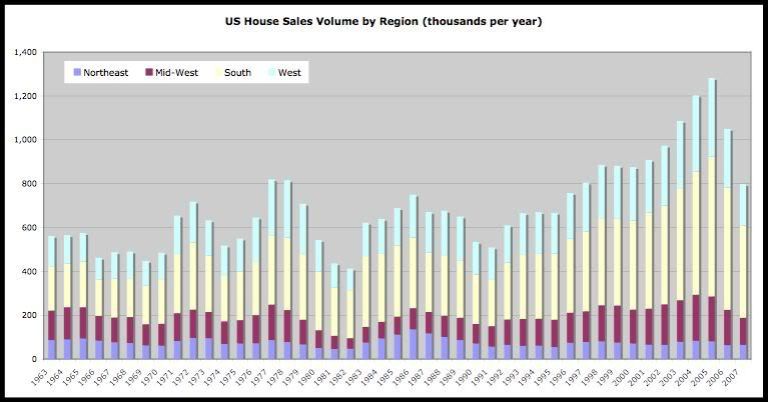

The chart above reflects median values across the entire US and therefore don’t reflect the nuances of specific markets. So I started looking at sales volumes by region, which is interesting… but couldn’t find home values by region. I’d love to do the trendline in YOY change for each region. (it’s amazing how dead the NE has been in the last couple decades)

It’s going to be an interesting few years coming up. I wonder if values will decline much with the massive drop in sales volume in 07 and likely 08. If history is any indication… other than a dip for a couple years perhaps, we should see a continuation of value growth, making 2008 and maybe 2009 great investment years.

Then again, if the decline in the growth rate continues as the trend line (two charts above) indicates, the next decade could mean only modest annual percentage gains, perhaps on par with what we will likely see CPI rise to in the coming years. If that’s the case, then aside from the tax benefits it provides, suddenly – real estate doesn’t look so sweet. And with home equity being such a significant driver of consumer spending – and with consumer spending representing nearly 2/3rds of economic growth, it makes you think about the implications to the US economy.

But I’m bullish anyway, I think.

I found your site on technorati and read a few of your other posts. Keep up the good work. I just added your RSS feed to my Google News Reader. Looking forward to reading more from you.

Mike Harmon

While I think I am a bull at heart, I feel that we are in for a UGLY bearish next two years (at least) ….. I see too much more carnage on the horizon. We are currently feeling the credit effects of the first “shoe” to drop. Primarily the “subprime” moniker that is really the code word for creative high LTV finance- both bad credit and good credit borrowers. The next shoe should start exposing itself with all of the Pay Option ARMs (and there are a TON of them) that will be resetting to a full amortization schedule- in some cases doubling or tripling the borrower’s current monthly payment. This should happen beginning in March.

The big difference between this and the first shoe is that the first defaults are primarily houses priced below $500,000 that have gone into default. Now selling in the $300’s, they become attractive to investors who can rent them out and cover the debt service…. Hanging on until the market does turn around. Pay Options are a different matter. Most of the pay Option ARMs were made to school teachers, policemen, state workers, Realtors, builders, etc. as a “stated income” qualification loan. They chose this loan because they could afford the minimum payment (which was less than the interest that was accruing) and still keep up with the rest of the Joneses that had to live in a $1 million neighborhood. Since homes were on a 20%+ annual appreciation tear over the past several years, that “myopic” feeling was that any deferred interest added on to the loan balance would be offset by the rapid appreciation and they were a refinance away from getting out of the loan if it became too onerous. The problem: With the home values declining, suddenly the 90% financing when the home was purchased means that they are deep under water and going more so each month as their loan balance continues to grow. While investors are beginning to pick up cheap houses, these Pay option ARMs (POAs) were used to purchase homes over $700. The problem when these start going into default is two-fold. 1. Traditional buyers of these homes are move-up buyers who were originally first time home buyers. A lot of these buyers have just had their homes foreclosed on and are now renters with trashed credit. 2. Even discounted, these homes are too pricy to rent and have the debt service covered- so investors wont bite. Who then becomes the buyers for these homes????

You are right on about the comment about home equity cash drying up consumer spending….. Yet we are getting reports that the consumer continues to spend these past six months…… What gives?? How are they spending when incomes are remaining fairly stagnant? You know how hard it is to give up a certain standard of living. When you are used to buying a Starbucks latte’ each morning and eating out 3-4X week becomes habit, it’s hard to tighten the belt until the balance on all credit cards are tapped and there are no other assets (home equity) to draw upon. THAT is when the slimy s*&% will hit the fan. My guess is it will begin in March of this year when the POAs begin their amortization recast. In all likelihood the Feds will need to create a fund that purchases these mortgages and uses bond financing (govt. guaranteed money) to keep people in their homes. They are trying to get lenders to do something similar right now, but Wall Street is punishing these “for profit” lenders. They have neither the cheap cost of capital nor patience of their shareholders to accomplish this on the massive scale they will face.

So, IF this happens, how do we take advantage of it? Like the “don’t come” line in craps, there is always a way to benefit if the game is played right. From short-selling stock, buying put options, buying and holding seriously discounted real estate, etc. With the aging demographics, can we pick up properties cheap, retrofit them with wide doorways and low countertops and turn them into care facilities? Is there any federal assistance or rent subsidy money to help do this?

Of course, our economy has proven itself to be incredibly resilient over time and with the influence of the global markets, maybe it’s China, Dubai or another UAE nation that bails us out, as a national depression would have a worldwide affect. With the dollar at all-time lows, international buyers are already starting to pick up US properties. Eyes open… It will definitely be an interesting next couple of years.

Fantastic reply. Time will tell.

Saw this cool graphic showing population migration across the US 1790. Pretty cool.